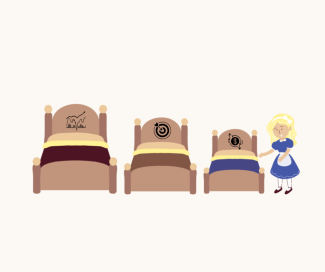

Call this a “Goldilocks” economy.

Today Gross Domestic Product first estimates for the last quarter of 2023 were released. The economy expanded 3.1% from a year earlier due to strong consumer spending and hiring. The domestic US economy continues to defy predictions for a slowdown or recession imminently. It seems the stock market predicted this good news with the rally concentrated mostly in the last quarter of 2023. The stock market has continued to rally based on rate reduction expectations by the Federal Reserve as well as slowing inflation and continued spending by consumers and businesses. We used to call this a “Goldilocks” economy. The disconnect between the data including wage increases and the general negative sentiment of consumers continues to infect Americans. Recent consumer sentiment numbers from the University of Michigan survey indicates trending improvement in sentiment in both the current measure and future sentiment: https://news.umich.edu/sentiment-soars-as-consumers-expect-easing-of-inflation

Consumer surveys also indicate that when questioned about their own personal finances, consumers feel confident but when questioned about the economy in general, they are less positive. Reminds me of surveys about congressional representatives and Senators. Individuals are favorably inclined in regard to their particular representative or Senator but have seriously negative sentiment towards Congress in general. This is an election year so sentiment about the economy is very important in determining the outcome of the election. James Carville famously said when managing the Bill Clinton campaign “It’s the economy stupid”. Will this be true this year or will other factors determine the election results. At Davos last week, the Wall Street Journal reported that US CEOs were ready to accept the possibility of Donald Trump winning the Presidential election which was a change in sentiment. I have a rule to not invest based on any political development. Markets are more interested in other factors.

In the News

For Long-Term Stock Investors, This Market Peak Won’t Matter - The New York Times (nytimes.com)

Why you should buy from resale, second-hand stores instead of new - The Washington Post

Schwab Says RIA Custody Is a Tough Business. So Why Are Competitors Scrambling to Get In? (msn.com)

Turn On This New iPhone Setting to Protect Your Money and Photos (msn.com)

Don’t Like Your Medicare Advantage Plan? Now’s the Time to Switch. (msn.com)

This website is informational only and does not constitute investment advice or a solicitation. Investments and investment strategies recommended in this blog may not be suitable for all investors. SAS Financial Advisors, LLC and its members may hold positions in the securities mentioned within this newsletter. SAS Financial Advisors, LLC is not responsible for any third-party content referenced.

The SAS Newsletters are posted on the SAS Blog weekly: