AI Bubble or Not? A Good Question.

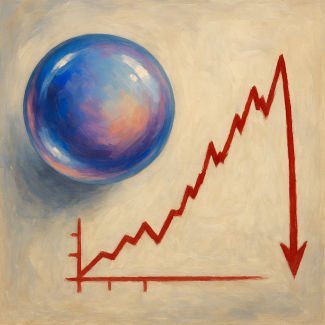

After several weeks of analysts beating the drum about a potential AI bubble, Nvidia delivered blowout earnings—only for many of the same analysts to pivot and say this proves we are not in a bubble. Yet despite Nvidia’s strong forward guidance, concerns about an overvalued market and a potential AI-driven disconnect remain.

Today’s market captured that uncertainty perfectly. Stocks opened with big gains, reversed by mid-morning, and swung over 3% intraday—ultimately closing sharply negative.

The employment report added its own contradictions. While the top-line number of jobs created looked positive, the unemployment rate ticked higher. And because employment data is backward-looking, it doesn’t necessarily reflect current labor market conditions. This mixed picture only deepens the complexity of the Federal Reserve’s upcoming December meeting.

For more context on recent economic contradictions, revisit our posts:

uncertainty in the economy

overvalued vs. undervalued markets

Affordability: The Real Pressure Point

As we’ve noted before, most Americans’ personal finances are not tied to the stock market. Many are living paycheck to paycheck, squeezed by inflation that remains closer to 3%, rather than the Fed’s 2% target. Yes, this is significantly lower than the 2021–2023 period, but after repeated assurances that prices would come down, people are frustrated—both with their personal financial strain and with the broader economy.

This pressure arrives just as the holiday spending season begins.

Walmart’s earnings came in higher than expected, with a positive forward outlook. Why? Their average shopper income has increased, reflecting a growing trend: Americans are trading down to less expensive alternatives.

Fast-food data reflects this shift as well. As Gemini (Google AI) summarized:

“The fast-food restaurant industry in Q3 2025 showed a strong trend of value-focused offerings and digital integration as a response to persistent consumer caution and inflation.”

A Seasonal Reminder

As we enter the holiday season, we send warm wishes to our SAS community. And a quick reminder: we still have tickets available for SFJAZZ and our dumpling dinner for the SAS Holiday Celebration.

If you're interested in a fun night away from the chaos of the world, make sure to sign up—

we would love to see you there.

This website is informational only and does not constitute investment advice or a solicitation. Investments and investment strategies recommended in this blog may not be suitable for all investors. SAS Financial Advisors, LLC and its members may hold positions in the securities mentioned within this newsletter. SAS Financial Advisors, LLC is not responsible for any third-party content referenced.

The SAS Newsletters are posted weekly on the SAS Blog: https://www.sasadvisors.com/blog