This is the time of year when we reflect on our lives and reach to provide donations to causes and non-profit organizations that reflect our goals to do better, be better, or do more for others. We have discussed Donor Advised Funds (DAFs) in previous newsletters and this week we will offer another option for giving. Charitable giving can be done by way of Required Minimum Distributions, such as RMDs from pre-tax retirement accounts such...

The bipartisan infrastructure plan was signed into law this week with a big yawn from markets. It is easy to forget that traditional thinking is: markets are always discounting in advance and expecting occurrences that might have an impact. Records for new highs in stock market averages were anticipating financial intervention in the form of infrastructure. The implementation of the infrastructure legislation will take time and will have little impact on the economy in the...

This week’s newsletter and blog headlines: Costs continue to climb-for how long? Infrastructure week? Infrastructure 10 years Climate change and cow belching Covid deaths, blue vs red counties Recognizing and remembering our Veterans on Veterans Day 11/11/2021 Additional Resources: Retirement Plan and IRA Required Minimum Distributions FAQs Costs continue to climb-for how long? At the beginning of the Pandemic, I suggested several trends would occur. One was increased investment in our healthcare system to accommodate...

Required Minimum Distributions Required Minimum Distributions, or RMDs, are required again after being waived for all in 2020. Our assumption for clients who have pre-tax accounts under SAS management is that instructions for those receiving RMDs before 2020 are the same. If they are different please let us know. If 2021 is the first year for your RMD then book a time to meet with us to discuss your options. RMD rules for 2021 state...

This has been the week of Facebook so far. The “Facebook Paper” whistleblower gave volumes of research to journalists from many newspapers who published articles dissecting the Facebook strategy of putting profits over doing right by its users or for social good. Facebook created a fictional person living in North Carolina who expressed mild interest in conservative politics and within a week she was receiving advertisements and links to QANON, the conspiracy-laced right-wing group. Facebook...

This term emerged because of the huge shift in the workforce since the pandemic began in March 2020. The initial shock to the world of work was massive layoffs as businesses shut down across America. Massive federal government intervention held back some of the economic disruptions in households and businesses. “Quits” as the labor department calls them, are rising in almost every industry. The Quits surged in April and exceeded that number this past July...

So many twists and turns, unintended consequences, mysteries, successes, and failures in the course of the pandemic. We know that massive monetary and fiscal intervention reversed a steep decline in the stock market and economic paralysis. In some senses, that was one of the easiest parts of decisive government decisions. As the pandemic has dragged on, the unified efforts of the government have become mired in politics and the vicissitudes of human behavior. One highly...

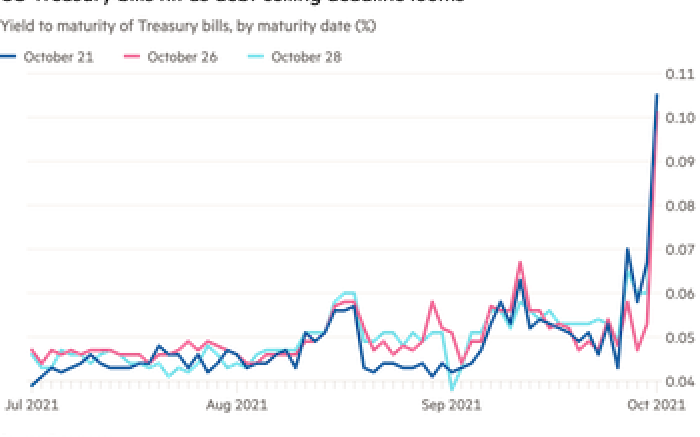

Yes, this has been seriously suggested as a solution to raising the debt limit. This would not be just any coin-not even a gold coin-but a Platinum coin. The way it would work is the President would order the US mint to create a Trillion $ coin and deposit it at the US Treasury. This Trillion $ could then be used to pay US government obligations. The reason it would be platinum is that legislation...

We talked to a prospect this week about investing in the stock market and he said that he is very nervous about all the uncertainty and lack of confidence in the markets. My response was “when did you not feel nervous about the stock market?” He laughed, agreeing that we are always worried about markets. It always feels like today is the worst it gets, forgetting the last time we felt this way. I hope...

Advice for this week is to take a deep breath and drink lots of water! So many converging crises that it is challenging to pick just one! It seems that the crises are never ending since the financial meltdown. The difference this week is the stock market is taking note. The decline from average highs is only about 3%, but pockets of the market have declined more significantly. Analysts are predicting declines of 20%. No...

Headlines last week discussed the change in the financial outlook of Social Security. The link below digs deeper into the methodology and impact of this analysis. Here is a link to the Center for Retirement Research at Boston College, one of the most objective think tanks focusing on Retirement. We recommend taking a look at their website if you are interested in this topic. The stock market stalled last week after week after week of...

With interest rates staying so low throughout the world, the attraction of riskier assets such as stocks remains high. An example of this attraction to risk is in the European markets where junk bond yields are lower than current inflation rates of 3%. There is no end to bond purchases by central banks in Europe so interest rates remain bearing mostly negative yield, including the 10 year benchmark German Bund with a -.32% yield. The...